To Equity or Not to Equity – That is the Question

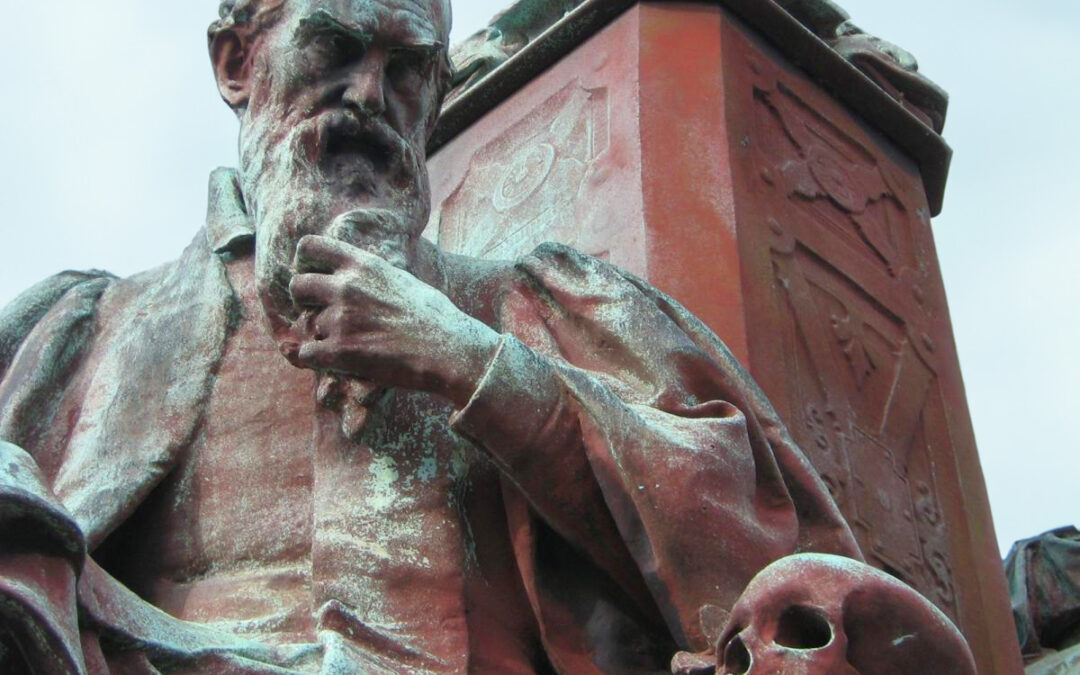

In the opening lines of Hamlet’s soliloquy, the question “To be, or not to be, that is the question” indeed presents a profound existential dilemma. Hamlet contemplates the merits of existence versus non-existence, grappling with the complexities of life’s struggles and the unknowns of what comes after death. While on the surface it may seem straightforward to prefer life over death, Hamlet’s introspection delves deeper into the nuances of human experience and the uncertainties that accompany both choices.

Similarly, in the context of corporate governance and board members’ equity ownership, the question of “to equity or not to equity” reflects a multifaceted decision-making process. It’s not merely a matter of whether equity ownership is inherently beneficial or not, but rather a consideration of the broader implications, trade-offs, and ethical dimensions involved.

Just as Hamlet weighs the pros and cons of existence, corporate boards must weigh the benefits and potential drawbacks of insisting or not insisting on equity ownership. This includes considerations of alignment of interests, long-term strategic vision, diversity and inclusion, regulatory compliance, and stakeholder value creation. The question encapsulates the complexity of decision-making in governance and the need for thoughtful analysis and deliberation.

In the dynamic realm of corporate governance, one of the perennial debates revolves around whether board members may or must hold equity in the companies they oversee. This discussion has gained renewed vigour in recent years and one I get asked a lot. There is a North American Hedge Fund, that of the companies that they invest in insist that its directors hold stock. They’ve adopted a strict principle of voting against directors who have served for two or more years but have invested less than two years of director’s fees into the company’s stock. This is spurred by evolving industry trends and shifting perceptions of corporate leadership.

Traditionally, equity ownership by board members has been seen as a sign of alignment of interests between the board and shareholders. It implies that board members have a vested interest in the company’s long-term success, as their own financial gains are tied to the company’s performance. This alignment is often touted as a mechanism to incentivise board members and CEOs to make decisions that are in the best interests of ‘all shareholders’ thereby enhancing corporate governance and accountability. This thinking can fly out the window when you have mature founding shareholder directors with large holdings without the same time horizons as others.

However, the landscape is not without its complexities and nuances. In today’s business environment, some argue that the focus on equity ownership can lead to narrow short-term thinking. Board members may prioritise immediate financial gains over long-term strategic initiatives that could benefit the company in the long run. This short-termism can be detrimental to sustainable growth and innovation, potentially undermining the company’s competitiveness and resilience.

The notion of equity ownership as the ultimate alignment tool has been challenged by alternative approaches to board compensation and governance. Some companies opt for performance-based incentives that are tied to key metrics such as operational performance, market share growth, or environmental, social, and governance (ESG) targets. These incentive structures are designed to incentivise behaviours that align with broader corporate goals beyond just shareholder value.

Another consideration is the diversity of perspectives and experiences that board members bring to the table. Staunch equity ownership requirements may inadvertently limit the pool of potential board candidates, excluding individuals who could offer valuable insights and expertise but may not have the means to invest significantly in company equity. Emphasising diversity and inclusion in board composition has gained traction as a means to enhance board effectiveness and decision-making.

In light of these considerations, the debate on equity ownership for board members has evolved into a nuanced discussion that takes into account multiple factors:

- Alignment vs. Short-termism: While equity ownership can align interests, it must be balanced against the risk of short-term thinking that may neglect long-term strategic priorities.

- Performance-based Incentives: Alternative incentive structures can provide alignment while also promoting a focus on broader corporate goals beyond immediate financial gains.

- Diversity and Inclusion: Equity requirements should not limit board diversity, as diverse perspectives are valuable for effective governance and decision-making. (for more on this topic, see Appointing the Right Board to Avoid Groupthink, TRANSEARCH Australia)

- With culture being such an essential aspect of an organisation’s success, it starts at the top with the board, how they behave, what they condone and how they are incentivised. (for more on this topic, see How Boards can play a critical role in shaping organisation DNA and Culture, TRANSEARCH Australia)

- Regulatory and Disclosure Considerations: Regulatory frameworks and disclosure requirements play a role in shaping board compensation practices and transparency around equity ownership.

As the corporate governance landscape continues to evolve, boards and companies must carefully weigh these factors to determine the most effective approach to board compensation and alignment of interests.

Returning to our parody of Shakespeare’s Hamlet, the question remains, “To equity or not to equity?”

Ultimately, both Hamlet’s existential question and the corporate governance question highlight the importance of introspection, critical thinking, and a holistic understanding of the factors at play. They invite us to delve beyond surface-level assumptions and engage in deeper reflections on the nature of choices and their implications.

If you would like to discuss any of the considerations I have presented in this article or if I can be of assistance with TRANSEARCH Board Services for your organisation, please contact me or connect with me on LinkedIn.

Photo: Modified from original by Alan Miller, Creative Commons Licence, 2007.

Lindsay Craig is the Managing Partner of TRANSEARCH International Perth. Over 25 years’ experience in the retained Executive Search industry has allowed him to build an extensive and valued network of local, national and international executives and directors. He works closely with boards and senior leadership teams on structure, remuneration and talent strategies. Based in Perth and operating internationally, Lindsay has completed assignments across many sectors recruiting Chief Executive Officers, Managing Directors, RVPs CIOs, CFOs, COOs, Non-Executive Chairs and Directors, General Managers and Functional Heads. As a result of appointments in the Mining & Resources sector, he has extended his reach into North & South America, Africa, the UK and Russia. Read more…